Users simply enter Company, Customer and Invoice information in the different input worksheets. The diagram below shows how the spreadsheet is organized.

Any user with a basic understanding of a spreadsheet will be able to use this spreadsheet to meet the needs of a corporation. Finally, as the printed invoice is designed as a worksheet, it can be easily customized to suit the corporate look-and-feel of the organization. With this storage and display capability, the invoice information can be printed and reprinted just by selecting a row in the invoice information table. Invoice information is also stored in table format and this allows summary information such as total sales and taxes to be calculated easily. The customer information is designed to be captured and stored in a table (similar to a database table) and easily accessed and retrieved for different invoices. However, this makes it difficult to summarize the data to derive useful information for further business analytics.ĬonnectCode’s Invoice Spreadsheet is designed from the ground up to solve the problems mentioned above. It is possible to store the information in each individual invoice.

On top of that, items printed in invoices will also need to be stored for accounting purposes.

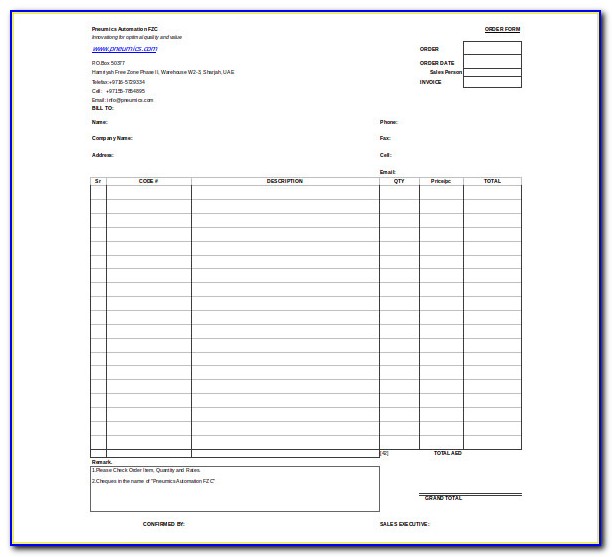

The customer information of an invoice needs to be easily accessible and reusable. Even with capabilities of copy-and-paste in a spreadsheet, errors can still occur. For example, it is onerous to key in the customer information and address each time an invoice is required. However business owners will quickly realize that printing of an invoice is an important yet very small step in the documentation and organization of items sold by a business. Windows XP®, Windows 2003, Windows Vista® and Windows 7įreeInvoiceTemplate.zip (Zip Format - 97 KB)įrom Invoice Templates to a Professional Invoice SpreadsheetĪn invoice template is useful. Both the service and product invoice templates can be found in the “InvoiceTemplates.xls” spreadsheet. The subtotal, taxes and total amount due are calculated automatically. The diagram bellow shows both the service and product invoices.Īn “x” in the “Taxed” column field indicates item is taxable. This is not required in a service invoice. In a product invoice, the amount of an item is derived by multiplying the quantity with the unit cost. Both product and service invoice templates in A4 and Letter sized formats are provided. This document describes a collection of free templates and a professional spreadsheet designed to ease the printing of invoices for small business owners.

0 kommentar(er)

0 kommentar(er)